Friday, September 28, 12:16 PM Apple (AAPL) wanted to build its Internet radio service into the iPhone 5 from the start, but was unable because of stalled licensing talks with music publisher Sony/ATV (SNE), the NY Post reports. Sony/ATV is said to want a higher-than-normal royalty rate for Apple's service, for which Apple is seeking to include features not supported by Pandora (P) and others. Among the features are the right to play a particular artist more often, and the promoting of tracks favored in a given month by music labels.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Shares of Pandora (P) have had a rough month of trading in September. Actually, shares have had a rough patch of trading since the $20 IPO price in June of last year. But given Apple's recent comments on entering into internet radio, Pandora shareholders may have something to look forward to. As the tech giants Apple (AAPL), Google (GOOG),Facebook (FB) and Amazon (AMZN) all look to leap over one another and drive more users to their websites, Pandora's rapidly growing user base may be one piece of the puzzle.

As consumers shift their preferences away from traditional media outlets and instead turn to smart phones, tablets, and even in-car communication displays, the topic of internet radio heats up. Pandorafinished August with 56.2 million active listeners; this was a 48% increase from the same period last year (note: Pandora has 150 million registered users). Additionally, the company accounted for 6.3% of all US radio listening in August, an increase from 3.67% in the same period last year. This is no small company, and although the financial statements have remained in the red for the past few years, the access to this rapidly growing consumer base is what the big players want to acquire.

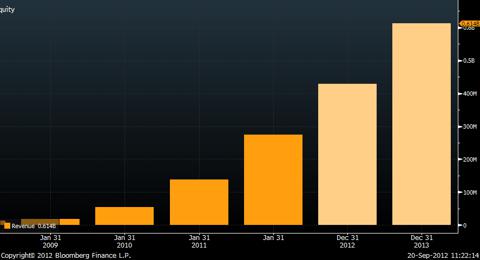

Proof of this growth is confirmed on the top line of the income statement and expectations for future revenue growth continue to be geared towards the upside. As of the company's fiscal second quarter earnings report, management's guidance for full year revenue is between $425 million and $432 million. This is a mid-50% jump from the last fiscal year. As you can see in the chart below, many analysts are calling for revenue to top $600 million by the end of calendar year 2013 (Pandora's fiscal year ends in January). As more and more subscribers sign up, more and more advertising revenue will accrue.

Source: Bloomberg

Although the Apple announcement a few weeks back was very vague, it is likely the new services would come in the form of a pre-installed app for iPhones and iPads. The service will likely be able to pull data from the users iTunes account and create custom radio channels, very similar to Pandora. Apple can then sell ads through their iAd platform and keep consumers directed towards what they deem most relevant. A radio service is just another piece of the total Apple package that the company is swiftly developing.

This is a major threat to rival Google. When Apple dropped Google Maps on its new products, a line was drawn in the sand, and the battle of these tech giants dramatically increased. There is no doubt that Google is heavily evaluating the internet radio growth space and how they can get a foot in the door. Given their massive cash position, roughly $44 billion, scooping up a company like Pandora whose market cap is currently $1.8 billion wouldn't even dent the balance sheet. Google could then integrate their AdWords and AdSense services with Pandora to create a much more enjoyable user experience (Google is the company that knows the most about our individual tastes and preferences on a wide variety of topics). The integration with Android devices, which are easily surpassing iPhone sales, is another major selling point.

Amazon, which sits on roughly $5 billion in cash, is another potential bidder for Pandora. With the launch of Kindle fire HD tablet, being able to integrate a unique internet radio service may prove a major selling point to consumers when evaluating the tablet market. Imagine you are listening to your favorite song and an ad from "Amazon MP3" pops up reminding you that you can purchase that song in addition to over 20 million songs through Amazon.com. Considering that Pandora is the number one referral source to iTunes, Amazon can quickly change the way we purchase music. Rumors of Amazon developing a smartphone also cause the mind to wonder.

Pandora represents 74 percent of all internet radio listening, and according to EMarketer Inc, generates more revenue from mobile-device ads in the United States than every company except for Google. Facebook's biggest criticism since becoming a public company has been their inability to monetize Facebook. Pandora could be a great way to keep users connected to Facebook and provide relevant ads based upon what you and your friends like. You could have posted pictures of yourself at the recent Dallas Cowboys game and the next day Jerry Jones pops up on an ad after your song finishes, letting you know the Cowboys are offering discounted tickets to the next home game. This is a very brief example: Facebook could leverage Pandora to a much greater magnitude than many of the other companies mentioned.

Maybe it's not worth getting into this discussion yet, since Apple has not officially declared their intentions of launching an internet radio station. Considering the fact that estimates place the total revenue of internet radio under $1 billion annually, the tech giants would barely feel a dent from this added service. So is it worth investing in Pandora today? Should you wait until more clarity develops in the internet radio industry?

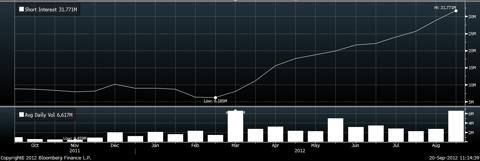

Shares of Pandora have been beaten down since their IPO, and the market apparently feels they could fall further. Short interest (see graph below) has done nothing but rise over the past few months, and currently 46% of the float is sold short!

Source: Bloomberg

Before you get scared off by the short interest, consider the fact that any positive news from Pandora could create a short squeeze. And with so many investors betting against this stock, the squeeze could shoot shares higher, similar to Yelp (YELP) back on August 29th. One potential approach is to scale into positions in Pandora. This way you don't risk moving all your capital into a "dead" investment for the next few months, but if any announcements are made, at least you have some skin in the game.

If any of the big tech companies move, the others will likely follow. Whether they decide to create a radio service internally or make an acquisition, the industry will likely be making a shift very soon. Given that the share price of Pandora has been roughly cut in half since the IPO, and they have the largest presence in internet radio, bidders may be lining up to grab an attractive company.

*Note: All data reported and graphed is pulled directly from Pandora Media's SEC filings and press releases.

No comments:

Post a Comment